Housing’s worst crisis in decades reverberates through 2024 election

“We have to prioritize housing as a national issue,” San Diego's Mayor Todd Gloria said in August.

By Shruti Date Singh, Skylar Woodhouse and Prashant Gopal | Bloomberg

The Democratic mayor of Phoenix recently declared the US housing crisis an “all hands on deck challenge.” Her counterpart in Columbus, Ohio, lamented its toll on “every rung of the socioeconomic ladder.” The mayor of New York City bluntly proclaimed, “We have to get in the business of building housing.”

Their words reflect an increasing sense of urgency about the nation’s worst housing quagmire in decades – and help explain how a topic that is often confined to local zoning board hearings and city council meetings has ended up at the center of national politics.

Democratic nominee Kamala Harris has made housing one of the few areas where she has offered relatively detailed policy proposals, which include tax credits for builders that construct starter homes and $25,000 in down payment assistance for certain buyers.

Also see: 44% surge in Orange County home sellers fails to boost buyer activity

GOP rival Donald Trump wants to open up federal land for housing development and has pledged to help with affordability by eliminating regulations.

These ideas are overtures to an electorate that faces a stark reality: Homeownership affordability reached its lowest since at least 2006 in October, and still hovers near that level, according to an index from the Federal Reserve Bank of Atlanta. That in part reflects the higher interest rates that the Fed wielded to tame inflation, but also a severe supply shortage that’s been in the making since the housing market collapse of 2008.

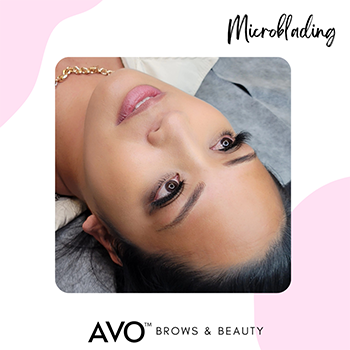

“We have to prioritize housing as a national issue,” said San Diego Mayor Todd Gloria at an event at the Democratic National Convention in August. “We have responsibilities at the local level, but we need federal assistance to be able to get this job done. Federal intention and investment can be a game changer.”

More on housing: Got $300,000? That’s typical Orange County downpayment, 3rd highest in US

At stake in the next two months are the votes of frustrated homebuyers and renters in battleground states that could determine who reaches the White House and which party controls Congress.

Longer term, without more supply, US cities face the potential loss of teachers and first responders who can’t afford to live where they serve. And like in other countries across the globe facing housing squeezes, legions of voters could miss out on the wealth accumulation that homeownership has provided for generations.

Swing-state impact

In swing states including Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin, the median monthly payment for homebuyers has nearly doubled since the 2020 presidential election to a record $2,161, according to a July report from brokerage Redfin.

Also see: Rate cuts won’t fix a global housing affordability crisis

A Bloomberg News/Morning Consult tracking poll of these seven states finds that voters consistently say the economy is their top priority in the 2024 election. When asked in August which economic factors carry the most weight at the ballot box, swing-state voters selected housing costs more often than unemployment, pay raises or interest rates.

The Democratic party, in particular, appears to have keyed in on this focus. Harris was quick to mention her housing plan in her first answer during Tuesday night’s debate with Trump.

Her campaign has gone on the airwaves in Arizona and Nevada – which were hit especially hard among swing states by soaring housing costs – with an ad touting her homebuilding agenda. A group called YIMBYs For Harris – a reverse reference to opponents of “not in my backyard” thinking – raised more than $100,000 in an August fundraising call.

The vice president has an advantage on the issue that she and her allies can try to build on: Swing-state voters in the August poll said they trusted Harris over Trump to handle housing costs by a margin of 4 percentage points.

“I know what homeownership means and sadly right now it is out of reach for far too many American families,” Harris said in the new campaign ad. “We will end America’s housing shortage by building 3 million new homes and rentals.”

Harris’ plans also include “cracking down on corporate landlords and Wall Street banks hiking up rents and housing costs to bring prices down for our families,” said Dan Kanninen, her campaign’s battleground states director, in an emailed statement. “But under Trump, life will only get more expensive, with his Project 2025 agenda raising millions of Americans’ housing costs while his wealthy friends profit.”

Political obstacles

Still, it won’t be easy for Harris to score political points with her plan – nor to implement it, if she wins the White House.

In the Bloomberg News/Morning Consult poll, her down payment assistance plan was widely favored by the Democrats who comprise her base, but had less appeal with independent and undecided respondents. That suggests the plan is most potent with the voters who are already in Harris’ corner.

Trump will also be blasting Harris’ plan on the campaign trail, arguing that she and President Joe Biden’s administration caused the housing affordability crisis.

The former president “has a real plan to defeat inflation, bring down mortgage rates, and make purchasing a home dramatically more affordable,” Karoline Leavitt, his campaign national press secretary, said in an emailed statement. She added that “illegal aliens” are driving up housing costs but Trump will “cut taxes for American families, eliminate costly regulations, and free up appropriate portions of federal land for housing.”

When it comes to Harris putting her proposals into action, Mark Zandi, an economist who advised her campaign on the plan, said it would make sense for the down payment assistance to come only after an expansion of supply — otherwise, it could simply stoke demand and thereby pump prices even higher. While a four-year term might be an ambitious timeline for building 3 million housing units, Zandi said five to eight years is possible.

As for the likelihood of getting these proposals passed by Congress, Zandi said the strategy of focusing on private-sector solutions, such as the builder tax credit, will have the advantage of appealing to lawmakers on both sides of the aisle.

Of course, builders will need labor, materials and other resources, which are already being stretched by infrastructure and manufacturing projects. But with government tax breaks at stake, “that’s a big incentive to figure out the labor constraints and get it done,” said Zandi, who’s the chief economist for Moody’s Analytics.

Trump will have his own challenges making inroads on this issue. The federal lands at the heart of his plan are often located far from metro areas with abundant jobs. Plus, the role of migrants in the housing market is nuanced. New arrivals fuel demand, but in some markets like New York, they are also a major source of the construction workforce, and thus would be integral to efforts to boost supply.

Plus, whichever candidate wins the White House will still face the problem of a tangle of local regulations and zoning ordinances that are often shaped by an area’s political bent, demographic shifts and socioeconomic composition. These local rules play a key role in spurring or stifling housing starts.

‘On steroids’

Multifamily builders have focused on market-rate units, including many higher-priced studios and one-bedrooms for affluent young singles. What’s scarce is affordable housing, with the National Low Income Housing Coalition estimating the US has a shortage of 7.3 million available rental homes that are affordable to tenants with extremely low incomes.

The roots of today’s housing crunch — the one lamented by Phoenix Mayor Kate Gallego, Columbus Mayor Andy Ginther and New York Mayor Eric Adams, among others — took hold well over a decade ago. After the 2008 financial crisis, which was a consequence of a housing bubble, construction projects slowed dramatically and workers fled the industry.

More recent conditions, though, have added to the strain and helped put the issue in a national spotlight. In particular, high interest rates have convinced many homeowners to stay put, causing annual existing home sales to fall in 2023 to the lowest in almost 30 years.

The crisis has been “put on steroids and has become acute as a consequence of the pandemic, inflation, interest rates and all the things that we know,” said Patrick Gaspard, president of the left-leaning think tank Center for American Progress.

:quality(85):upscale()/2025/02/27/808/n/1922398/26784cf967c0adcd4c0950.54527747_.jpg)

:quality(85):upscale()/2025/01/08/844/n/1922398/cde2aeac677eceef03f2d1.00424146_.jpg)